Tesla shares have recently taken a hit in the stock market, dropping by over 7% in premarket trading. This decline follows CEO Elon Musk’s surprising announcement to create a new political entity known as the “America Party,” which has raised significant investor concerns regarding its potential impact on Tesla’s future. As Musk dives deeper into politics, many are left wondering how these pursuits correlate with Tesla’s business objectives. Investors worry that Musk’s political ambitions could overshadow the company’s focus, especially given the ongoing discussions about contentious laws that could affect the broader economic environment. With heightened scrutiny surrounding Tesla shares, the intersection of business and politics couldn’t be more critical.

The fluctuations in Tesla’s stock can be partly attributed to the CEO’s latest venture into political waters, a move that has stirred both interest and anxiety among stakeholders. Musk’s desire to form the “America Party” could have unforeseen ramifications for his electric vehicle company, igniting a debate about the effects of political maneuvering on business integrity and investor confidence. The announcement has sparked concerns over how the new political landscape might influence the automotive industry’s trajectory and Tesla’s competitive edge. As investors digest the implications of Musk’s political activism, the pressure mounts to maintain focus on the core business amidst rising competition and changing consumer preferences. This political involvement, notably perceived as a distraction, adds complexity to the already fluctuating scenario surrounding Tesla shares.

The Impact of Elon Musk’s New Political Party on Tesla Shares

Tesla shares experienced a significant drop in premarket trading on Monday, coinciding with CEO Elon Musk’s announcement regarding the formation of a new political party, named the “America Party.” The stock saw a dip of 7.13%, reflecting investor concerns about Musk’s dual role as a tech innovator and a political figure. This move into politics comes at a pivotal time for Tesla, as the company grapples with numerous challenges including production issues and the fierce competition in the electric vehicle market. Investors are naturally apprehensive that Musk’s political ambitions could distract him from his core responsibilities at Tesla, potentially jeopardizing the company’s financial stability and market image.

As the founder of Tesla, Musk’s decisions carry significant weight on the stock market. Many investors worry that his political pursuits could complicate Tesla’s narrative amid ongoing challenges such as a 14% year-on-year drop in car deliveries. Instead of focusing solely on technological advancements and product delivery, stakeholders are concerned that Musk’s engagement with the political landscape could lead to further volatility in Tesla shares. The intersection of politics and business is often fraught with challenges, and many investors fear this foray could overshadow the company’s innovation and growth.

Additionally, the potential political impact on Tesla is magnified by Musk’s previous involvement with the government, specifically during his tenure with the Department of Government Efficiency. This prior association ignited discussions among investors, causing a pullback in Tesla shares during those times. Analysts highlight that any perceived misdirection in Musk’s priorities could lead to a decline in investor confidence. Dan Ives from Wedbush Securities notes that many Tesla shareholders have growing exhaustion with Musk’s political ventures, a sentiment that could further weigh on stock performance if left unaddressed. Thus, the announcement of the America Party adds another layer of complexity to an already volatile investment landscape for Tesla shares.

Investor Concerns Over Elon Musk’s Political Engagement

The announcement of Musk’s new political party has stirred a wave of skepticism among investors, who are concerned that his political aspirations could distract him from Tesla’s operational challenges. Historically, during times when Musk was deeply entangled in political issues, Tesla shares tended to experience fluctuations, raising eyebrows among investors about his focus and the company’s growth trajectory. The timing of this political engagement, particularly amid a backdrop of disappointing quarterly results, intensifies worries that Musk’s ambitions could overshadow the immediate goals that Tesla needs to prioritize to maintain shareholder confidence.

Moreover, recent comments made by Trump regarding Musk’s political ambitions being “ridiculous” may further complicate the narrative for Tesla. Investors are keenly aware that political affiliations can impact business operations and public perception. Many stakeholders fret that Musk’s new political party could generate a polarizing effect, potentially alienating customers and investors who might disagree with his political stance. As a result, there’s a growing consensus that Musk’s involvement in the founding of the America Party may no longer align with the interests of Tesla shareholders who favor a more focused business strategy rather than political engagement.

This dual existence of Elon Musk as both a visionary CEO and a budding political figure brings with it a host of uncertainties. Investors worry about how Musk’s opinions and actions in the political realm might influence public sentiment towards Tesla, especially in a climate where any misstep can have immediate repercussions on stock performance. As competition in the electric vehicle market intensifies and complications arise from policy disagreements, it becomes imperative for Musk to navigate these waters carefully. The perception of a divided focus may prompt existing and potential investors to reassess their stakes in Tesla, a move that could further impact the stock value in the short and long term.

Tesla Stock Performance Amidst Musk’s Political Moves

Following the announcement of the America Party, Tesla stock has reacted negatively, dropping over 7% during premarket trading. This decline is a reflection of mounting investor skepticism regarding how Musk’s political ambitions could affect the company’s future. With Tesla battling a drop in car deliveries and increasing competition from rivals in the electric vehicle sector, investors are concerned that any distraction could hamper the company’s recovery efforts and long-term strategy. Analysts suggest this is particularly troubling as Tesla attempts to navigate through challenging market conditions in essential regions like China where competition is fierce and growing.

Additionally, this downturn in Tesla shares highlights investors’ demand for a focused leadership approach that prioritizes immediate business challenges over political pursuits. The focus on core competencies and operational executions is what Tesla needs to bolster its market position. Investors may become increasingly wary if they perceive Musk as being more invested in political discourse than in steering the company through its current operational hurdles. In light of such volatility, the key to restoring investor confidence will be consistent communication and a clear delineation of Musk’s priorities between his political future and Tesla’s business agenda.

Moreover, the impact of Musk’s political ventures is compounded by the broader economic climate, which is affecting technology stocks across the board. Investors are closely monitoring how national policies related to electric vehicles and sustainable energy might change following political shifts. Any adverse political actions or policy changes emerging from Musk’s new party could create further uncertainties regarding subsidies or support for the electric vehicle industry, underscoring the interconnectedness between political developments and Tesla’s stock performance. For Tesla shareholders, the emphasis now lies on deciphering how much of Musk’s political engagement will influence the company’s strategic direction moving forward in an increasingly competitive landscape.

Challenges and Opportunities for Tesla Amid Political Developments

As Elon Musk steps into the political arena with the new America Party, Tesla faces a unique set of challenges intertwined with opportunities for growth. The uncertainty surrounding Musk’s political involvement raises questions about its potential implications for the brand, especially when investor sentiment is already fragile due to Tesla’s recent performance. Nevertheless, for some, this move could also be seen as an opportunity to align the company with political ideologies that promote innovation in the clean energy sector, potentially reopening doors for collaboration with government initiatives that support electric vehicles and renewable energy sources.

Simultaneously, navigating the political waters could benefit Tesla if Musk leverages his influence to advocate for favorable policies and subsidies that support electric vehicle adoption. As competition mounts, strategic political engagements could allow Tesla to solidify its market position more firmly within policy discussions. However, investors remain skeptical about the balance Musk must maintain between his political ambitions and ensuring Tesla’s operational success. Addressing these challenges will require strategic foresight and perhaps a more measured approach to political involvement to mitigate risks while exploring new avenues for growth.

The juxtaposition of political engagement and corporate performance presents a complex landscape that Tesla must navigate. While some investors express concerns about Musk’s aim to establish a political party during a critical phase for the company, others perceive potential upsides if political advocacy aligns with industry interests. It’s crucial for Tesla’s leadership to clarify how these political moves can complement the company’s mission and vision in the electric vehicle domain. Should Musk succeed in positioning the America Party favorably within the political framework, he could not only enhance Tesla’s prospects but also shore up investor confidence through the assurance that he can balance both political aspirations and corporate governance effectively.

Elon Musk’s Influence on Tesla: A Double-Edged Sword

Elon Musk’s influence is both a boon and a bane for Tesla, particularly with his recent pivot towards political engagement. His entrepreneurial vision has driven Tesla to the forefront of the electric vehicle industry, captivating investors and consumers alike. However, as Musk dives deeper into politics, concerns arise that this might dilute his focus on Tesla’s operations. Investors are beginning to question whether his political endeavors, such as the establishment of the America Party, may detract from vital tasks, especially in light of current dips in production and delivery targets. The balance between innovation and political distraction is a tightrope that Musk now has to walk, and any missteps could exacerbate the fragile state of Tesla shares.

Moreover, while Musk’s charisma and bold moves have often rallied his supporters, the backlash from investors can be profound when perceptions of misalignment with Tesla’s operational goals arise. Many investors have voiced exhaustion with Musk’s political pursuits that seem to overshadow the successes that should stem from innovative leadership. As he embarks on this new political journey, the anticipation for Tesla’s next moves grows, along with fears that Musk’s distractions could lead to a decline in market performance. Ultimately, the challenge lies in leveraging his unique influence for the greater good of Tesla while aligning with shareholder expectations.

In the realm of corporate governance, the implications of Musk’s political actions extend beyond stock prices. Tesla’s brand image is at stake; a leader who is perceived as politically divisive could alienate customers in a market that values social responsibility and sustainability. As he attempts to establish a political identity, Musk must remain cognizant of how these affiliations can affect consumer perceptions of Tesla and its mission. Navigating this tricky landscape will require not only a deft approach but also a clear communication strategy that reassures investors that Tesla is stable and focused on delivering on its promises. This balancing act could very well define the future trajectory of both Musk and the Tesla brand in the years to come.

Investing in Tesla: A Risk or Opportunity?

Investing in Tesla shares has historically been viewed through a lens of opportunity given the company’s pioneering leadership in electric vehicles. However, the recent announcement regarding Elon Musk’s formation of the America Party introduces a level of risk that investors must carefully consider. As Musk delves into the political landscape, the potential for distraction from Tesla’s core operational focuses raises alarms among current and prospective shareholders. With the backdrop of declining deliveries and intensifying competition, the stakes for Tesla’s stock performance are higher than ever. Investors must weigh the potential upside of Musk’s political connections against the immediate risks of steering Tesla through turbulent market conditions.

The electric vehicle market is rapidly evolving, and investor interest in sustainable technologies has never been greater. However, one must also consider that political affiliations and initiatives can result in unpredictable shifts that could greatly affect Tesla’s growth trajectory. Whereas the establishment of the America Party could present opportunities for strategic partnerships that align with Tesla’s mission, it is imperative for investors to remain vigilant and assess how these developments may influence Tesla’s future performance. Proper risk assessment and a thorough understanding of the potential implications of Musk’s dual-focus will be essential for making informed investment decisions.

Ultimately, the question remains: is investing in Tesla shares a sound decision or a calculated risk? The answer lies in both an investor’s appetite for risk and their belief in the company’s long-term vision. Musk’s political venture could either amplify Tesla’s reach and influence within the industry or serve as a significant distraction that compromises shareholder value. Drawing on both historical performance and current developments will be crucial as investors navigate this evolving narrative. For some, the chance to support a transformative leader in clean technology is worth the associated risks, while others may choose to adopt a more cautious stance until there is greater clarity on how political influences will shape the future of Tesla shares.

Frequently Asked Questions

What caused the recent drop in Tesla shares?

Tesla shares recently dropped by 7.13% in premarket trading after CEO Elon Musk announced his plans to launch a new political party called the ‘America Party.’ This move raised investors’ concerns about Musk’s increasing political involvement and its potential impact on Tesla’s business narrative.

How might Elon Musk’s new political party affect Tesla stock?

The establishment of Elon Musk’s ‘America Party’ may lead to increased volatility in Tesla stock as investors worry about the implications of his political pursuits on Tesla’s reputation and operations. Concerns have grown among investors regarding how Musk’s focus on politics might detract from his leadership role at Tesla, especially during a crucial period for the company’s growth.

What are investors saying about Elon Musk’s political involvement and Tesla shares?

Many investors express growing concerns regarding Elon Musk’s political engagement, particularly his recent announcement to form a new political party. Industry analysts, like Dan Ives from Wedbush Securities, believe that Musk’s political ambitions could be detrimental to Tesla’s narrative, especially as the company faces operational challenges and competition.

What is the potential political impact on Tesla due to Musk’s actions?

Elon Musk’s foray into politics by creating the ‘America Party’ might have significant political impacts on Tesla. Investors fear it could divert attention away from the company’s core business, particularly as Tesla has experienced a 14% drop in car deliveries and increasing competition in markets like China.

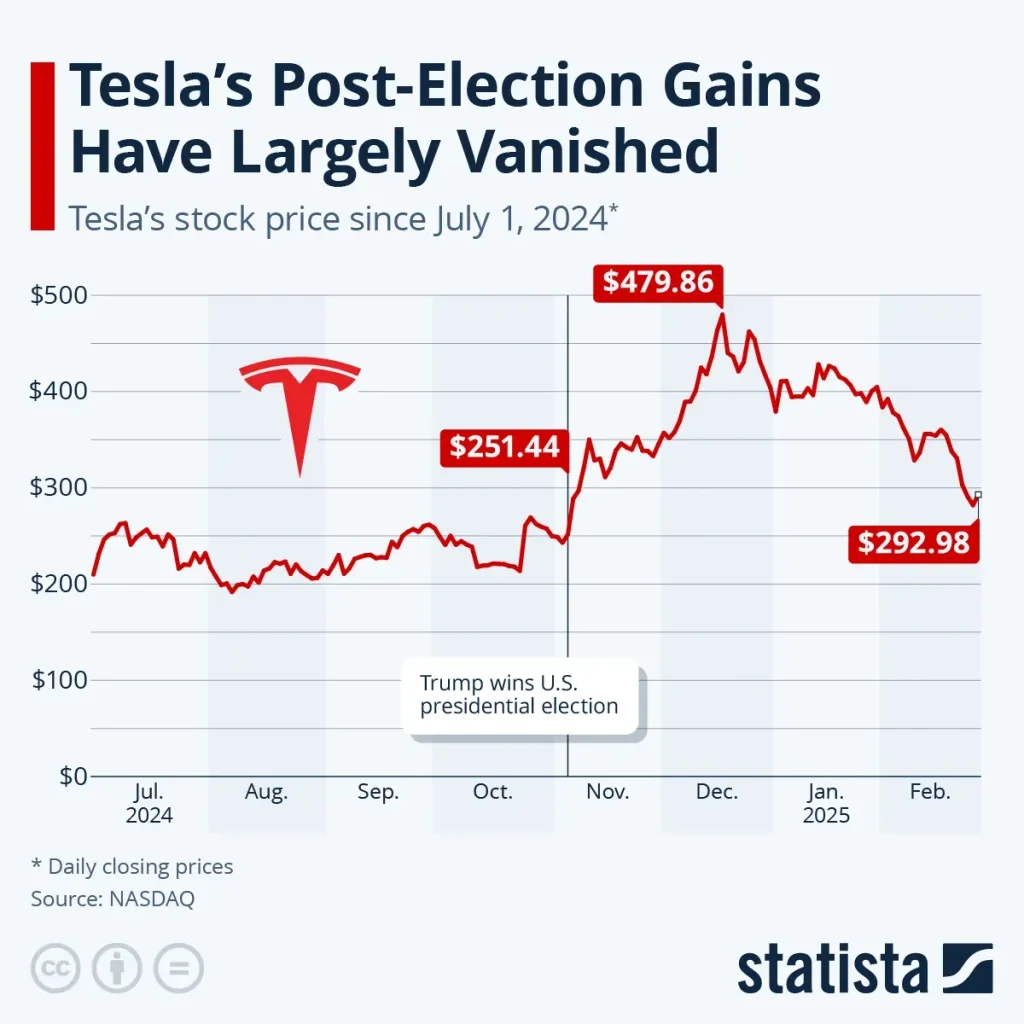

How have Tesla shares performed alongside Elon Musk’s political announcements?

Tesla shares have shown increased volatility in response to Elon Musk’s political announcements, such as the recent dip of 7.13% in premarket trading. This decline is largely attributed to investor concerns over Musk’s dual focus on politics and his responsibilities as Tesla’s CEO, potentially leading to a negative impact on the company’s market performance.

| Key Point | Details |

|---|---|

| Tesla Shares Drop | Tesla shares fell 7.13% in premarket trading after Elon Musk planned a new political party. |

| America Party Formation | Musk announced the ‘America Party’ with a focus on 2 or 3 Senate seats and 8 to 10 House districts. |

| Investor Concerns | Musk’s political involvement has raised alarm among investors, raising doubts about Tesla’s brand. |

| Criticism from Trump | Trump labeled Musk’s political party plans as ‘ridiculous’, showing a rift between them. |

| Delivery Challenges | Tesla faced a 14% year-on-year drop in car deliveries in Q2, raising competition fears. |

| Investor Fatigue | Investors are growing tired of Musk’s political ventures during critical times for Tesla. |

Summary

Tesla shares have experienced a significant decline following CEO Elon Musk’s announcement of his new political party, raising concerns among investors about the implications for the company’s brand and operations. As Musk navigates challenging political waters and faces disappointing delivery reports, investor sentiment grows weary of his political distractions, leading to uncertainty in Tesla’s future.