In a recent update, the United Airlines 2025 forecast reflects a nuanced outlook as the airline navigates a recovering travel landscape. With CEO Scott Kirby expressing optimism, he noted that the world is experiencing a decline in uncertainty, which bodes well for travel demand 2025 and the overall airline earnings forecast. United Airlines anticipates earnings between $9 and $11 per share this year, a revision from earlier predictions. Despite a challenging first half, trends in airfare and shifting consumer expectations are beginning to shift positively. As analysts keep a close watch, United’s news showcases their strategic responses to evolving travel capacities and consumer preferences.

As airlines adjust to a fluctuating market, the latest projections from United Airlines for 2025 highlight essential shifts in their operational strategies. Key trends surrounding air travel demand, ticket pricing dynamics, and United’s financial outlook are of paramount importance to stakeholders. CEO Scott Kirby has underscored that reduced uncertainty in global travel can inspire consumer confidence and bolster airline performance. The insights into United Airlines’ earnings expectations reveal a comprehensive analysis of rising travel trends and consumer spending habits within the aviation sector. Following this forecast, stakeholders will be keenly observing how United and its competitors adapt to continue flourishing in the post-pandemic travel environment.

United Airlines 2025 Forecast: Earnings Predictions and Challenges

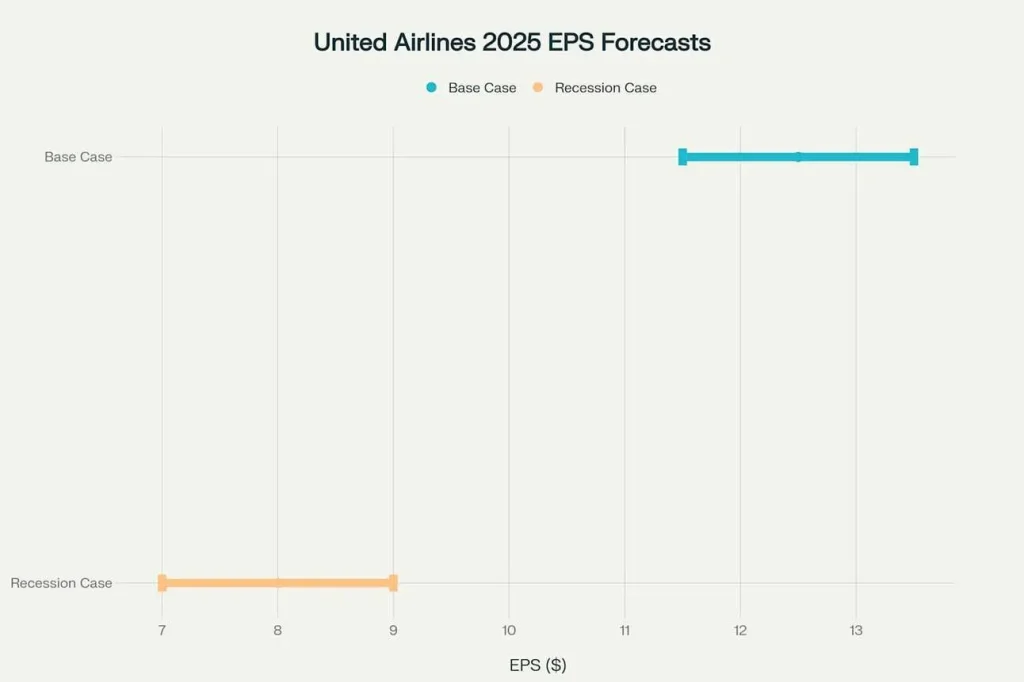

In its latest update, United Airlines has adjusted its earnings forecast for 2025, now anticipating earnings between $9 and $11 per share, a significant dip from earlier predictions of $11.50 to $13.50 per share. This shift reflects the airline’s response to changing dynamics in travel demand and the broader economic landscape. CEO Scott Kirby noted that while there had been initial optimism about travel recovery, the realities of operational constraints at key hubs, particularly Newark Liberty International Airport, have necessitated a reevaluation of their financial outlook.

The downshift in United’s forecast highlights the inherent volatility in the airline industry, with external factors such as economic uncertainty impacting investor confidence and pricing power. Analysts observe that while international travel remains robust, domestic passenger revenue has struggled to keep pace, contributing to weaker overall financial results. As airlines adjust to these shifts, the focus will remain on how United Airlines navigates these challenges while still aiming to meet analysts’ expectations for the upcoming quarters.

Travel Demand Trends for 2025: What Lies Ahead for Airlines

As we progress into 2025, the airline industry is witnessing a gradual uptick in travel demand, particularly from more price-sensitive domestic travelers, which had been weaker than anticipated earlier in the year. This resurgence in travel is notably a bright spot in an otherwise challenging context, as ticket prices experienced a notable drop due to oversupply in earlier months. However, airlines are now re-evaluating their capacity and pricing strategies, aiming to align with the rising demand trends without compromising profitability.

With CEO Scott Kirby’s assertion that the “world is less uncertain today,” US airlines, including United, are hopeful for a rebound in travel, particularly in the second half of 2025. This optimism is echoed across the industry, with competitors, such as Delta Air Lines, acknowledging similar trends but preparing for more conservative forecasts. As travel demand increases alongside evolving airfare trends, United will need to remain agile in its operational and pricing strategies to ensure its position in this competitive landscape.

Airfare Trends: What Travelers Can Expect

Airfare trends have been unpredictable, especially as the industry grapples with shifting consumer behaviors in 2025. Following a period of reduced prices due to oversupply, United Airlines, along with its competitors, anticipates a gradual increase in fares as demand stabilizes. This adjustment will be essential for maintaining healthy profit margins, particularly as operational constraints at major hubs have begun to pressure profitability metrics. As travelers resume booking, the expectation is for fares to reflect rising costs while balancing consumer appetites for travel.

The return of premium travelers opting for upgraded services indicates a willingness among some consumers to spend more for a better travel experience. United’s report of a 5.6% year-over-year increase in premium revenue highlights this trend, suggesting that while basic fares may fluctuate, the demand for premium products may buoy airline earnings. For travelers, navigating these airfare trends will be essential, particularly as insights into pricing strategies and demand forecasts become clearer in the coming months.

CEO Scott Kirby: Vision and Strategic Directions

Scott Kirby, the CEO of United Airlines, has outlined a strategic vision to navigate the complexities of the airline industry in 2025. Under his leadership, the airline has established proactive measures to adapt to fluctuating travel demand and economic uncertainties. His focus on enhancing customer experience and transparency has been pivotal in positioning United as a key player that prioritizes passenger needs amidst evolving market conditions.

Kirby’s forward-thinking approach includes fortifying operations at major hubs while addressing challenges that affect profitability. During the recent earnings call, he reinforced the importance of maintaining a flexible operational strategy that allows United to respond swiftly to both upward and downward shifts in travel demand. His assertion that current conditions are less uncertain signals a renewed confidence in the market, setting the stage for a potential recovery as United adapts to the changing dynamics of air travel.

Operational Constraints Impacting United’s Profit Margins

Operational constraints have emerged as a significant challenge for United Airlines, particularly at Newark Liberty International Airport, which has affected the airline’s pretax margins. Issues related to air traffic controller staffing shortages have led to a reduction in flight schedules, ultimately constraining the airline’s ability to maximize capacity and meet consumer demand effectively. As United navigates these challenges, it must strategically manage its resources and operational capabilities to mitigate the financial impact of these constraints.

The implications of these constraints are multifaceted, influencing not only earnings but also overall customer satisfaction. As the airline aims to recover from a decline in pretax margins, it may need to reassess its offerings and optimize routes to ensure operational efficiency. The ongoing dialogue surrounding these operational hurdles remains critical for stakeholder confidence, as industry observers continue to monitor United’s performance against its revised 2025 earnings forecast.

Analyzing Competition Among Major Airlines

In the competitive landscape of aviation, United Airlines is poised against formidable rivals, including Delta Air Lines and American Airlines, each navigating their unique hurdles as they advance into 2025. The recent decision by Delta to reinstate its full-year forecast at conservative figures underscores the cautious outlook shared across the industry. The airlines must balance their operational capabilities with market demand to maintain profitability amidst fluctuating airfare trends and evolving consumer preferences.

As competition intensifies, United Airlines will likely refine its marketing strategies and customer engagement efforts. Focusing on retaining and attracting loyal travelers will be essential for sustaining its market share. Understanding the competitive pressures and effectively responding to rivals’ strategies is crucial for United as they pursue their earnings goals in the year ahead while ensuring they deliver exceptional value to their customers.

Economic Climate’s Influence on Airline Profitability

The global economic climate plays a crucial role in shaping airline profitability, and 2025 is no exception. After a sluggish start to the year, United Airlines and its peers optimistically anticipate economic conditions stabilizing. As overall economic indicators improve, the airline industry expects to see increases in consumer confidence, which could lead to heightened travel demand. Still, the broader economic landscape remains fraught with uncertainties that could impact future performance.

Airlines, including United, must stay vigilant in responding to these external economic factors. The fluctuating nature of interest rates, fuel costs, and geopolitical dynamics all contribute to the complexity of forecasting airline earnings. As industry players analyze these economic indicators, being adaptable and strategically aligned with market trends will be critical to capitalizing on potential growth opportunities in the airline sector.

Navigating Future Challenges: United Airlines’ Strategies

Looking toward the future, United Airlines is focused on addressing and overcoming the multifaceted challenges it faces in 2025. With its revised earnings forecast and the impacts of operational constraints, the airline is actively implementing strategies aimed at enhancing efficiency and optimizing routes to better serve its customers. By embracing innovation and leveraging technology, United aims to improve its operational resilience, a necessary shift in an industry characterized by unpredictability.

Moreover, as CEO Scott Kirby emphasizes the need to remain agile in response to market trends, United is poised to explore new revenue streams and maximize existing resources. This includes committing to sustainability initiatives, which are increasingly becoming a priority for travelers. By focusing on these strategies, United Airlines not only seeks to achieve its financial objectives for 2025 but also to build a sustainable future in an evolving aviation landscape.

Frequently Asked Questions

What is the United Airlines 2025 forecast regarding airline earnings?

United Airlines has revised its 2025 earnings forecast to expect between $9 and $11 per share, down from an earlier estimate of $11.50 to $13.50. This adjustment comes amidst varying travel demand and economic uncertainties.

How is travel demand expected to impact United Airlines in 2025?

Travel demand for United Airlines in 2025 is projected to increase, particularly from more price-sensitive domestic travelers. CEO Scott Kirby indicates that the travel market is becoming less uncertain, which may contribute positively to the airline’s performance.

What are the key factors affecting United Airlines’ 2025 airfare trends?

Key factors impacting United Airlines’ airfare trends in 2025 include operational constraints at Newark Liberty International Airport and fluctuating demand from domestic travelers. Despite these challenges, there’s a noted increase in premium travel revenue.

How does CEO Scott Kirby view the economic climate for United Airlines in 2025?

CEO Scott Kirby remarked that the world feels ‘less uncertain’ now compared to earlier in 2025, suggesting increased confidence in achieving a strong finish for United Airlines. This improved sentiment may influence airline earnings positively in the upcoming quarters.

What does the latest United Airlines news indicate about their forecast for 2025?

Recent United Airlines news highlights a revised earnings forecast, with an anticipated range of $9 to $11 per share for 2025. The airline’s second-quarter earnings showed resilience despite lower revenue expectations, hinting at potential recovery in the market.

How are operational constraints affecting United Airlines’ 2025 financial projections?

Operational constraints, particularly at Newark Liberty International Airport, have negatively impacted United Airlines’ pretax margins. These challenges are expected to continue influencing the airline’s financial outlook as they navigate capacity and demand fluctuations.

| Key Points |

|---|

| United Airlines expects to earn between $9 and $11 per share in 2025, revised down from earlier estimates of $11.50 to $13.50. |

| The third-quarter forecast aligns with analysts’ expectations. |

| Operational constraints at Newark Liberty International Airport continue to affect pretax margins. |

| United reported higher second-quarter earnings than expected, with increased travel demand noted by the CEO. |

| While domestic airfares have decreased due to weaker demand, premium revenue rose by 5.6%. |

| Unit revenue for international flights, particularly to Europe, fell, indicating weaker pricing power. |

Summary

The United Airlines 2025 forecast indicates a cautious optimism as the airline projects earnings between $9 and $11 per share, reflecting a downward adjustment from earlier estimates. Despite facing challenges at Newark Liberty International Airport and fluctuating travel demand, United’s performance shows promise with a strong second quarter and a significant rise in premium revenue. The recent statements from CEO Scott Kirby suggest that the overall environment is improving, reinforcing confidence for a favorable conclusion to the year.