The Abbott Laboratories Q2 report brought mixed signals to investors as the diversified healthcare giant showcased solid financial performance yet fell short on future earnings guidance. For the three months ending June 30, revenue climbed by 7.4% to $11.14 billion, surpassing expectations, while organic sales jumped 7.5%, surpassing analyst forecasts. Despite adjusted earnings per share (EPS) rising to $1.26, slightly above consensus, the company’s inability to raise its full-year earnings guidance led to a sharp 8% decline in stock value. Investors are now closely examining Abbott’s stock analysis and earnings outlook, especially as diagnostics sales were notably weaker than expected. Overall, the Abbott Laboratories review reflects a company with potential, albeit tempered by cautious forecasts and ongoing market challenges.

In the latest earnings update, Abbott Laboratories presented a nuanced picture of its financial health amid evolving market dynamics. The healthcare company’s second-quarter results highlight notable growth in major segments, even as forward-looking statements prompted concern among analysts. As the focus shifts towards Abbott earnings guidance and stock performance, the shortcomings in diagnostics sales and other areas draw scrutiny. Competing in the fast-paced healthcare sector, Abbott continues to navigate a landscape filled with both opportunities and challenges. The conversation surrounding Abbott’s recent performance not only informs potential investors but also highlights broader trends in healthcare stock performance.

Abbott Laboratories Q2 Report Highlights

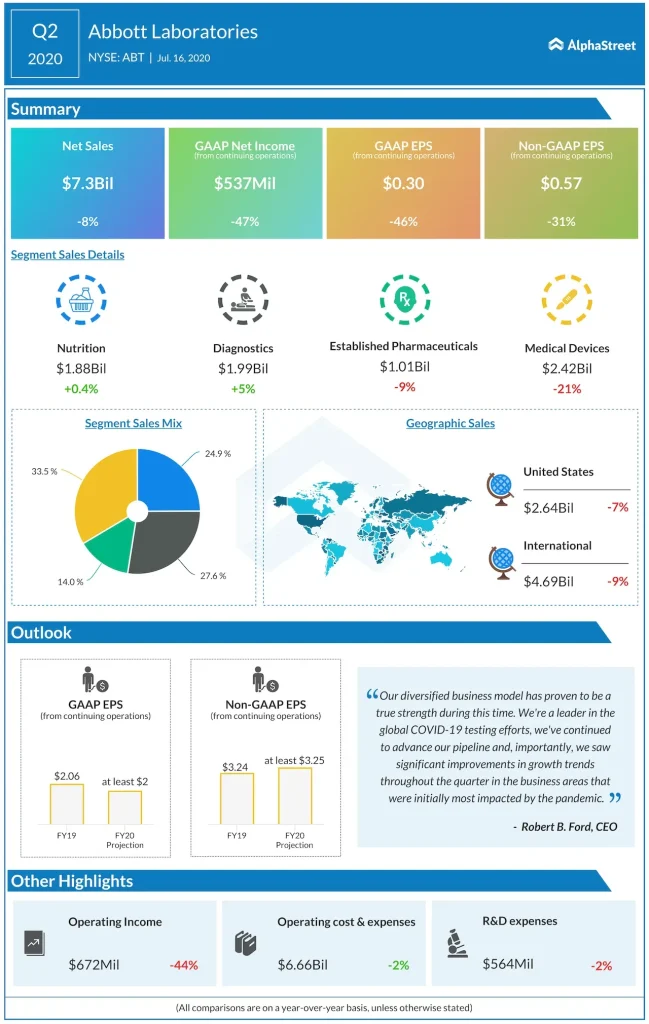

Abbott Laboratories reported a robust performance in its Q2 earnings, showcasing a 7.4% increase in revenue to $11.14 billion, exceeding market expectations. This growth was primarily driven by a solid performance in its Medical Devices and Established Pharmaceuticals segments. Notably, adjusted earnings per share rose by 10.5% year-on-year, slightly surpassing analysts’ predictions, which reflects the company’s resilience in a competitive healthcare landscape. Investors had anticipated a more optimistic forward guidance, which was a key factor impacting the stock price following the report.

Despite the positive revenue growth and better-than-expected adjusted EPS, concerns were raised due to the company’s tight full-year earnings guidance. The adjusted operating margin forecast of 23.5% at the lower end of the previously indicated range does not align with investor expectations for higher profitability. This cautious outlook, combined with underperformance in the Diagnostics and Nutrition segments, contributed to an 8% drop in Abbott’s stock price post-announcement, indicating a clear disconnect between current performance and future potential as perceived by investors.

Frequently Asked Questions

What were the key highlights from Abbott Laboratories Q2 report?

Abbott Laboratories Q2 report showcased a 7.4% revenue growth, reaching $11.14 billion, surpassing estimates. The adjusted earnings per share (EPS) rose by 10.5% year-on-year to $1.26, slightly above expectations. However, the report was tempered by disappointing forward guidance.

How did Abbott’s earnings guidance change following the Q2 report?

Following the Q2 report, Abbott’s earnings guidance was tightened, with the full-year EPS forecast adjusted to a range of $5.10 to $5.20, compared to the prior $5.05 to $5.25 range. This adjustment disappointed investors hoping for an increase.

What factors contributed to Abbott’s stock performance after the Q2 report?

Abbott’s stock faced an 8% drop post-Q2 report due to disappointing forward guidance and a weaker than expected forecast for the third quarter. Despite strong performances in Medical Devices, concerns over diagnostics and nutrition sales affected investor sentiment.

What was the performance of Abbott’s diagnostics segment in Q2?

Abbott’s diagnostics segment reported a 1.4% organic sales decline in Q2, missing estimates. Excluding Covid testing, the growth was only 0.8%. CEO Robert Ford noted that excluding China, core lab diagnostics showed an 8% increase due to strong demand.

How did Abbott’s Medical Devices sales perform in Q2?

Abbott’s Medical Devices segment outperformed expectations in Q2, highlighted by a robust 19.6% organic increase in continuous glucose monitoring sales and double-digit growth across Heart Failure, Structural Heart, and Electrophysiology categories.

What is Abbott’s position on the ongoing litigation related to its specialized infant formula?

Abbott maintains that its specialized formula for premature infants is medically endorsed, and CEO Robert Ford emphasized their commitment to compliance with regulatory decisions, stating that nourishing vulnerable infants is a medical, not legal, concern.

Was Abbott’s nutrition segment performance in Q2 in line with expectations?

No, Abbott’s nutrition segment fell short in Q2, with sales not meeting expectations. CEO Ford defended the segment, citing ongoing strong demand for their Ensure and Glucerna brands worldwide, despite recent sales challenges.

How did analysts respond to Abbott Laboratories’ Q2 report?

Analysts reacted to Abbott Laboratories’ Q2 report with caution due to the disappointing guidance. Although the revenue and EPS exceeded initial expectations, the stock’s decline reflected investor concern regarding future performance, particularly in diagnostics.

What are the implications of Abbott’s updated earnings forecast for investors?

The tightened earnings forecast suggests a cautious outlook for Abbott Laboratories, potentially signaling slower growth ahead. Investors may need to reconsider the stock’s value based on performance expectations for the remainder of the year.

What strategic growth areas does Abbott highlight in its Q2 report?

In its Q2 report, Abbott highlighted strategic growth in its Medical Devices sector, particularly in diabetes care and heart treatment technologies, while striving to regain momentum in its diagnostics and nutrition segments.

| Key Point | Details |

|---|---|

| Quarterly Revenue Growth | Revenue rose by 7.4% to $11.14 billion, surpassing consensus estimates. |

| Organic Sales Growth | Organic sales increased by 7.5%, above the estimate of 7.2%. |

| Adjusted EPS | Adjusted EPS rose by 10.5% year-on-year to $1.26, slightly above expectations. |

| Competitors | Main competitors include Dexcom, Boston Scientific, and Edwards Lifesciences. |

| Future Guidance | Full-year EPS forecast adjusted to $5.10-$5.20; a slight decrease from prior guidance. |

| Stock Reaction | The stock dropped by 8% following the earnings report due to disappointing guidance. |

| Diagnostics Performance | Diagnostics sales showed a 1.4% organic decline, primarily impacted by Covid testing sales. |

Summary

Abbott Laboratories Q2 report highlighted strong revenue and organic sales growth, but disappointing guidance led to a significant drop in share value. Despite a 7.4% increase in revenue and a slight uptick in adjusted earnings per share, concerns over future performance overshadowed these results. The company faces challenges in its diagnostics segment and ongoing litigation, leading investors to remain cautious about its stock. Overall, while Abbott continues to show resilience in its core businesses, the tempered outlook has made it prudent for investors to be vigilant and wait for clearer signals before making further investment decisions.