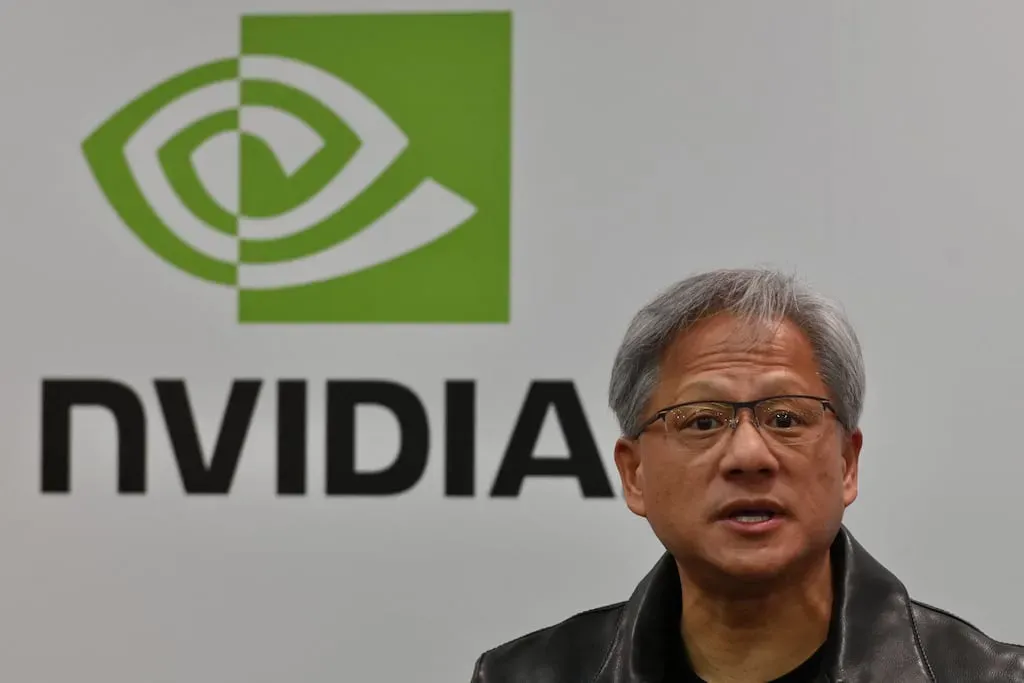

Nvidia CEO Jensen Huang’s share sale has become a significant talking point in the tech industry, as he offloaded 75,000 shares worth approximately $12.94 million, according to a recent SEC filing. This event is part of a strategic plan initiated in March, allowing Huang to sell up to 6 million shares of the renowned artificial intelligence powerhouse. Interestingly, this announcement comes alongside Nvidia’s plans to resume H20 chip sales to China, following positive signals from the Trump administration regarding export licenses. With the surging demand for AI technology, Huang’s stock sale raises questions about the future trajectory of Nvidia’s market capitalization, which has recently eclipsed $4 trillion. As the excitement around Huang’s actions intertwines with the booming market for advanced graphics processing units, industry analysts are eager to explore the implications of this pivotal moment for both Nvidia and the broader tech landscape.

The recent stock divestment by Jensen Huang, the prominent figure leading Nvidia, has garnered attention due to its timing and financial implications. Huang’s decision to sell substantial shares is tied to a broader framework that allows him to liquidate holdings over time, amidst ever-increasing demand for cutting-edge AI solutions. In a notable development, Nvidia has also signaled the possibility of reinstating sales of its next-generation H20 chips to Chinese markets, following governmental assurance regarding export licenses. As Nvidia’s market capitalization continues to soar, reaching historic heights, the interrelation of these corporate maneuvers with prevailing market conditions presents an intriguing narrative for investors and tech enthusiasts alike. Analysts are keenly watching how these factors will influence Nvidia’s position as the foremost leader in AI technology.

Nvidia CEO Jensen Huang’s Stock Sale Details

Nvidia CEO Jensen Huang’s recent stock sale has garnered significant attention in the financial markets. On Friday, he offloaded 75,000 shares valued at approximately $12.94 million, a move that is part of a broader plan allowing him to sell up to 6 million shares of Nvidia. This sale, as outlined in a new SEC filing, represents a strategic financial maneuver amid the soaring demand for artificial intelligence technologies. The increased interest in AI has greatly enhanced Nvidia’s market capitalization, now soaring past $4 trillion, placing it as a front-runner in the tech sector.

The ongoing stock sales by Huang highlight not just personal decisions but also the corporate strategy of Nvidia. Earlier this month, he sold an additional 225,000 shares, accumulating around $37 million in total from these transactions. This systematic approach to selling shares aligns with Nvidia’s growth trajectory, as the firm continues to capitalize on the booming AI technology market. Huang’s activities are closely monitored by investors and analysts alike, reflecting confidence in Nvidia’s ongoing innovations and advances in AI solutions.

The recent SEC filing regarding Huang’s stock sale illustrates a well-structured plan that underscores Nvidia’s robust position in the tech industry. As Huang navigates the complexities of stock sales, he is also paving the way for potential reinvestment opportunities that may arise from the profits accrued through these transactions. With Nvidia’s sustained focus on advancing its AI technology offerings, Huang’s stock sale could very well serve as a pivotal moment in his financial strategy, especially when considering the long-term growth prospects associated with the company’s flagship products.

Moreover, as Nvidia continues to drive demand for its cutting-edge AI technologies, shareholders and market analysts keep a vigilant eye on Huang’s decision-making process. The high stakes of the technology sector, especially related to the graphics processing units that empower machine learning applications, heighten the importance of transparency around such stock movements. Huang’s sales will be indicative not only of his confidence in the company’s future but also of the overall market sentiment concerning Nvidia’s share performance and expanding influence in the global tech landscape.

Impact of Nvidia H20 Chip Sales on Market Trends

The anticipated resumption of Nvidia’s H20 chip sales to China marks a critical juncture in the company’s global strategy, particularly as it relates to the surging demand for AI technologies. Following the favorable stance from the U.S. government regarding export licenses, Nvidia is positioned to capitalize on a lucrative market that has been curtailed over the past year. The H20 chips, tailored specifically for the Chinese market, are expected to complement Nvidia’s product line, enhancing its reputation as a leader in advanced graphics processing units.

As Nvidia engages with the Chinese market, its ability to sell the H20 chips could significantly influence its financial performance and overall market capitalization. The rebounding demand from China could drive Nvidia’s stock prices higher, appealing to investors looking for opportunities amid fluctuating market conditions. Given that Nvidia is already valued at over $4 trillion, this influx could further reinforce its dominance as the most valuable company in the tech sector. The implications of these sales extend beyond mere financial metrics, hinting at the geopolitical and economic nuances that characterize U.S.-China relations in the tech industry.

Furthermore, the H20 chip sales exemplify a vital aspect of Nvidia’s broader strategy to remain at the forefront of AI technology development. With the continuing evolution of AI requirements, these chips are instrumental in supporting cutting-edge applications ranging from deep learning to real-time data processing. As demand for such technologies escalates, Nvidia’s proactive measures to resume sales will undoubtedly play a crucial role in its market positioning.

In conclusion, the strategic decision to push H20 chip sales in China isn’t just about boosting immediate revenues; it represents a calculated effort to solidify Nvidia’s role within a rapidly changing tech landscape. The anticipated market reaction to this decision may serve as an indicator of future trends in AI technology demand and market behaviors, shaping the competitive landscape for years to come.

The impact of reinstating H20 chip sales is already being felt in the stock market, creating ripples of confidence among investors eager for Nvidia shares. Analysts are closely examining these developments to gauge their potential effects on Nvidia’s earnings trajectory and long-term growth prospects, highlighting the intricate connections between corporate strategy, market dynamics, and geopolitical shifts in technology sales.

Understanding Nvidia’s Market Capitalization Growth

Nvidia’s remarkable ascent to a market capitalization of over $4 trillion has been fueled by the surging demand for AI technologies and innovations in chip manufacturing. The company’s ability to capitalize on trends—such as the increasing utilization of artificial intelligence in various sectors—positions it as a major beneficiary in the technology landscape. The firm’s graphics processing units (GPUs), which have become essential for training large language models, are at the core of this phenomenon, reflecting an intense interest from industries seeking to integrate AI capabilities into their operations.

The growth in Nvidia’s market capitalization is not merely a consequence of rising revenues but also an indication of investor confidence in its future. As AI technology continues to advance, Nvidia has emerged not just as a supplier but as a key player in shaping the direction of tech innovations. The strategic decisions made by CEO Jensen Huang, including timely stock sales and the resumption of essential chip supplies, signal a robust management approach that recognizes and adapts to market demands effectively.

Moreover, Nvidia’s achievements are accentuated by its competitive edge in AI technology, driving continuous investment in research and development. As companies globally look for ways to integrate AI into their products and services, Nvidia is ideally positioned to meet this demand. This leads to a reinforcing cycle where increased investment enhances product offerings, attracting further interest from both consumers and investors, ultimately driving up market capitalization.

The implications of Nvidia’s market capitalization growth reach far beyond the company’s immediate financial health; they serve as an indicator of broader technological trends and advancements. The investment trends surrounding Nvidia’s stock reflect a commitment to increasingly sophisticated technologies and the standardization of AI across sectors. Analyst projections often view Nvidia’s trajectory as a template for other tech companies, framing the narrative of AI’s crucial role in current and future economic landscapes.

Anticipated Outcomes of Nvidia’s Chip Export Strategy

Nvidia’s strategic move to resume chip exports, particularly the H20 chips targeted for the Chinese market, carries substantial implications for the company and the global technology market as a whole. With recent assurances from the U.S. government regarding the approval of export licenses, the firm is poised to reclaim its position as a key supplier to a vital market that has seen suppressed growth in recent times. The ability to resume sales in China could significantly boost Nvidia’s revenue stream, extending its lead as a dominant force in the global semiconductor industry.

The expected outcomes of this strategy encompass not just financial benefits, but also the reinforcement of Nvidia’s brand as a leader in technological innovation. By meeting the demand for advanced AI chips in China, Nvidia can leverage this opportunity to enhance its market presence and influence substantially. This generative approach fosters deeper ties with international clients, setting a foundation for long-term partnerships that could yield additional avenues for growth.

Additionally, the resumption of chip exports will likely stimulate competitive responses from other semiconductor manufacturers who may aim to capture similar markets. As Nvidia continues to diversify its clientele and product offerings in the face of increasing competition, it will be essential for the company to sustain its innovation pipeline to retain its competitive edge. Thus, the success of the H20 chip sales may serve as a catalyst for further developments in AI technology, driving overall progress within the sector.

In summary, Nvidia’s proactive approach regarding chip exports will likely yield substantial outcomes in both a financial and competitive context. As demand for AI technologies escalates, Nvidia’s ability to strategically navigate market challenges and garner support from regulatory bodies will play a crucial role in determining its future trajectory within this rapidly evolving industry. The upcoming months will reveal the full impact of these strategic decisions as Nvidia endeavors to maintain its stronghold in the global tech market.

The Role of AI Technology Demand in Nvidia’s Success

The rapidly rising demand for AI technology has been a primary driver of Nvidia’s exceptional success in recent years. As industries across the globe increasingly integrate AI solutions into their operations—ranging from healthcare to finance—the need for powerful computing capabilities surges. Nvidia’s GPUs have emerged as the go-to solution for organizations looking to harness AI’s potential, efficiently training machine learning models that require extensive computational resources. This demand has consequently placed Nvidia at the forefront of the AI revolution, driving their market performance and attracting investment.

Furthermore, Nvidia’s continued commitment to innovation in AI technology has solidified its reputation as both a leader and innovator in the sector. By consistently enhancing their product offerings—such as developing the H20 chip—Nvidia ensures that it meets the ever-evolving needs of industries reliant on cutting-edge technology. The strategies employed by CEO Jensen Huang reflect adept foresight into market trends, allowing the company to maximize its growth opportunities while also responding to shifts in demand within the tech ecosystem.

The synergy between AI technology demand and Nvidia’s product portfolio creates a reinforcing loop that drives profitability and market growth. As organizations invest in AI advancements, their reliance on superior GPUs only increases, ultimately benefiting Nvidia. The company’s strategy to maintain its leadership position in AI technology not only fortifies its market capitalization but also positions it as a key player in shaping future technological landscapes.

Looking ahead, as the thirst for AI innovations intensifies, Nvidia is set to harness this momentum to further its goals. The company’s ability to adapt to changing demands within the tech landscape will be essential for maintaining its lead in AI. Consequently, Nvidia’s focus on AI technology will serve as a focal point for investors and analysts, reinforcing the understanding that the driving factors behind its market achievements extend beyond performance metrics to encompass a broader vision of future advancements.

Nvidia’s Corporate Strategy and SEC Filings

Nvidia’s recent SEC filings have become a focal point for investors analyzing corporate strategy amid a landscape marked by rapid advancements in technology. With CEO Jensen Huang’s significant stock sales detailed in these reports, it is clear that Nvidia is positioning itself for future growth while also providing transparent communications to stakeholders. These filings not only outline the specifics of stock transactions but also reflect the broader strategy aimed at maintaining investor confidence amidst fluctuating market conditions.

Furthermore, the information disclosed in SEC filings plays a crucial role in shaping market perceptions of Nvidia’s corporate governance and operational integrity. By adhering to regulatory requirements, Nvidia enhances its credibility among investors, contributing to the positive sentiment surrounding its stock performance. As the firm continues to navigate the challenges of a fast-paced tech environment, these transparent communications become increasingly vital for sustaining investor engagement.

In addition to promoting transparency, Nvidia’s filings also provide insight into how the company is allocating resources to guide its growth trajectory. With profits from stock sales likely funneled back into research and development, securing Nvidia’s innovative edge could very well be a linchpin in its strategic approach. By carefully managing its resources and staying attuned to shareholder expectations, Nvidia cultivates a cohesive strategy that balances immediate financial goals with long-term technological enhancements.

Ultimately, Nvidia’s SEC filings serve as a critical tool in conveying its corporate strategy and regulatory compliance. As the company charts its path in the tech industry, the emphasis on transparent communication, resource allocation, and innovative growth will play integral roles in sustaining its remarkable success.

Frequently Asked Questions

What recent share sale did Nvidia CEO Jensen Huang undertake?

Nvidia CEO Jensen Huang sold 75,000 shares on Friday, valued at approximately $12.94 million, according to an SEC filing. This sale is part of a larger plan adopted in March allowing Huang to sell up to 6 million shares of Nvidia, a leading AI technology company.

What does Jensen Huang’s stock sale mean for Nvidia’s market capitalization?

Jensen Huang’s recent stock sale comes as Nvidia’s market capitalization exceeds $4 trillion, making it the most valuable company in the world. The demand for AI technology and related hardware has significantly contributed to this increase in market value.

How does Jensen Huang’s stock sale relate to Nvidia’s H20 chip sales?

The sale of Jensen Huang’s shares is taking place amid Nvidia’s announcement of plans to resume H20 chip sales to China. This move follows recent assurances from the Trump administration regarding the granting of export licenses, indicating strong market demand for Nvidia’s AI technology.

What prompted the SEC filing regarding Jensen Huang’s recent share sale?

The SEC filing regarding Jensen Huang’s stock sale details his plan to sell shares of Nvidia as part of a broader strategy initiated in March. This includes the recent sale of 225,000 shares, amounting to around $37 million, reflecting Huang’s confidence in Nvidia’s continued success amidst rising AI technology demand.

How do Nvidia’s AI technology advancements impact Jensen Huang’s stock sales?

Nvidia’s rapid advancements in AI technology, particularly through products like the H20 chip, have not only boosted demand but also significantly increased Huang’s net worth. The ongoing success in AI has made Nvidia a leader in the semiconductor industry, thus affecting Huang’s decision to pursue stock sales to capitalize on this growth.

What is the significance of Nvidia’s H20 chip sales in relation to Jensen Huang’s share sales?

The resumption of Nvidia’s H20 chip sales is significant as it represents a major opportunity for the company in the Chinese market. This comes at a time when Jensen Huang is actively selling shares, reflecting both his confidence in Nvidia’s future prospects and the strategic importance of their product offerings amid high demand for AI technology.

How might Jensen Huang’s stock sale affect investor perceptions of Nvidia?

While Jensen Huang’s stock sale could raise questions among investors, it is essential to note that it is part of a pre-planned selling strategy. Given Nvidia’s strong market capitalization and the ongoing demand for its AI technology, including advancements like the H20 chip, the sale is not necessarily indicative of pessimism regarding the company’s future.

What implications does Jensen Huang’s latest stock trade have for future Nvidia developments?

Jensen Huang’s stock trade reflects a calculated approach amid a thriving market landscape for Nvidia’s AI technologies. With plans to resume H20 chip sales to China and expectations for advanced chip sales, Huang’s actions suggest confidence in Nvidia’s ongoing innovation and market leadership in semiconductor technology.

| Key Point | Details |

|---|---|

| Share Sale | Jensen Huang sold 75,000 shares valued at $12.94 million. |

| Total Shares Sold | A total of 225,000 shares were sold, amounting to around $37 million. |

| Sale Plan | Part of a plan adopted in March allowing the sale of up to 6 million shares. |

| Market Reaction | Increased demand for AI tech boosted Nvidia’s market cap to over $4 trillion. |

| H20 Chip Sales | Nvidia expects to resume sales of H20 chips to China following export license approvals. |

| Future Prospects | Huang expressed intent to sell more advanced chips to China in the future. |

Summary

The recent Nvidia CEO Jensen Huang share sale underscores significant developments for the tech giant. Huang’s transactions reflect strategic financial planning and heightened market interest in artificial intelligence technologies, evidenced by Nvidia’s soaring valuation and upcoming chip sales to China. As Huang moves forward with his share sales planned earlier this year, the implications for both Nvidia and the AI industry at large are promising, suggesting an upward trajectory in Nvidia’s growth and profitability.