Samsung Electronics Q2 results have revealed a mixed bag of fortunes as the company reported an operating profit of 4.7 trillion Korean won, a figure that fell short of market expectations. This decline can be attributed to stringent U.S. export restrictions affecting advanced AI chips targeted for the Chinese market. Although the quarterly profit reflected an increase from their own conservative forecast of approximately 4.6 trillion won, it marked a remarkable drop from the robust 10.44 trillion won profit posted during the same quarter last year. Additionally, overall revenue climbed to 74.6 trillion won, slightly surpassing expectations, indicating resilience in other business segments. In essence, the company faces hurdles in the semiconductor market while maintaining strong mobile sales, revealing the complex dynamics at play in Samsung’s financial landscape.

In the lately released financial performance of Samsung Electronics for the second quarter, the tech giant demonstrated the challenges faced within the semiconductor arena alongside notable gains in its mobile sector. The results paint a picture of a company grappling with profit declines due to AI chip export limitations while still achieving overall revenue growth. Factors such as market trends in semiconductor supply chains and the flourishing sales of flagship mobile devices contribute to this juxtaposition in results. Clearly, Samsung’s ability to navigate these contrasting segments underlines its strategic importance in the tech industry. With innovative offerings in mobile tech and ongoing adaptations to external market pressures, Samsung’s future strategies could shape its resilience moving forward.

Samsung Electronics Q2 Results: A Closer Look

Samsung Electronics reported its second-quarter operating profit at 4.7 trillion Korean won, falling short of market expectations. This profit, while slightly above the company’s own projection of 4.6 trillion won, represents a significant decrease from the impressive 10.44 trillion won recorded in the same quarter last year. This decline has been largely attributed to tough market conditions and U.S. export restrictions on advanced artificial intelligence (AI) chips to China, impacting the overall profitability of Samsung’s semiconductor division.

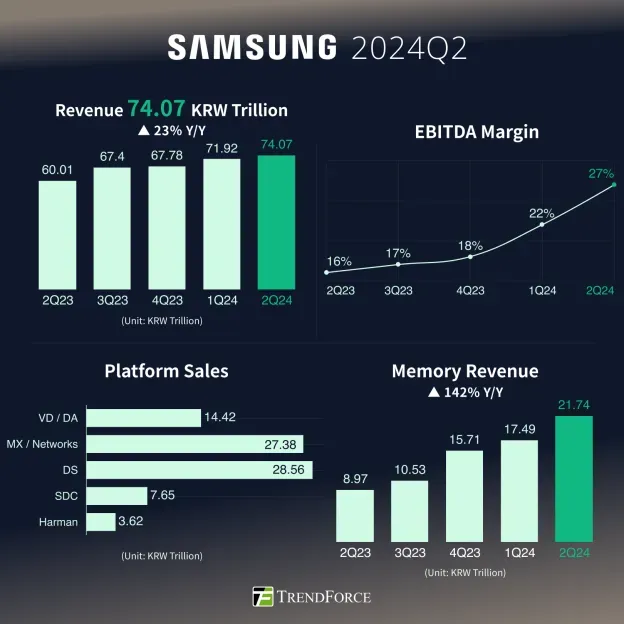

In terms of revenue, Samsung managed to achieve 74.6 trillion won, marking a slight increase from 74.07 trillion won a year prior. This revenue exceeded their forecast of 74 trillion won, indicating some resilience in their operations despite challenges in the semiconductor market. The overall results underscore the difficulties faced by Samsung in navigating ongoing geopolitical tensions and supply chain disruptions that have affected the semiconductor market.

Challenges in Samsung’s Semiconductor Business

Samsung’s Device Solutions division, which encompasses memory chips and semiconductor design, faced alarming challenges, showcasing a staggering 93.8% drop in operating profit year over year. The operating profit for this segment fell to 400 billion won in the second quarter, down from 6.45 trillion won last year. Such a steep decline highlights not just internal inefficiencies but also the external pressures from global market shifts, particularly the repercussions of AI chip export restrictions.

These export limitations have directly affected the semiconductor revenue, which plummeted to 27.9 trillion won compared to 28.56 trillion won a year earlier. Samsung cited inventory value adjustments in memory and additional costs arising from the export restrictions as key factors impacting profit. Moving forward, it remains essential for Samsung to recalibrate its strategies to adapt to the fluctuating semiconductor market trends and bolster its profitability.

Prospects for Samsung’s Foundry Operations

Despite the current challenges faced by its semiconductor division, Samsung’s foundry operations hold promising prospects. The announcement of a substantial $16.5 billion contract from a major company to supply chips has sparked optimism about future revenue streams. While the specific client remains undisclosed, speculations point towards Tesla, which could lead to further growth and stability for Samsung’s foundry business.

The anticipated uplift in the foundry segment underlines a critical shift as Samsung moves to secure and strengthen its position within the competitive semiconductor manufacturing landscape. By diversifying its offerings and leveraging partnerships, especially in advanced semiconductor technologies, Samsung aims to counterbalance the downturn in other areas of its semiconductor business.

Growth in Samsung Mobile Sales

On a more positive note, Samsung’s mobile experience and networks divisions reported significant growth in both sales and profit for the second quarter. The operating profit in this segment surged to 3.1 trillion won, a substantial increase from 2.23 trillion won a year ago. This growth has been fueled by strong demand for Samsung’s latest Galaxy S25 and Galaxy A series smartphones, indicating a robust rebound in their mobile sales amidst broader market challenges.

The revenue of the mobile segment reached 29.2 trillion won, up from 27.38 trillion won in the previous year. The strategic focus on flagship devices and AI functionalities has proven effective in attracting consumers, with plans for a flagship-first strategy on foldable devices and the popular Galaxy S25 series. This approach not only enhances market presence but also reinforces Samsung’s commitment to innovation within its mobile product lineup.

Samsung’s Strategy amidst Global Semiconductor Challenges

In response to the ongoing restrictions and challenges within the semiconductor market, Samsung is actively recalibrating its strategy. The company plans to focus on high-value-added and AI-driven products to cater to shifting customer demands. By emphasizing technological advancements, Samsung aims to enhance its competitiveness in advanced semiconductor sectors, aligning its research and development with market needs.

As the second half of the year approaches, Samsung is poised to adapt to rising market demands while confronting the complexities posed by export restrictions and inventory corrections. Continuous investment in innovation and strategic collaborations will be crucial for Samsung to navigate these turbulent times successfully, ensuring the company remains a key player in the semiconductor landscape.

Impact of Export Restrictions on Samsung’s Performance

The recent performance of Samsung Electronics has been significantly influenced by U.S. export restrictions on AI chips aimed at China. These restrictions have curtailed the capabilities of many semiconductor firms, including Samsung, forcing them to reassess their market strategies and operations. The impact of these restrictions is not just felt in the immediate financials but can also reshape the long-term outlook for Samsung’s semiconductor business.

Consequently, Samsung’s management is now more than ever focused on mitigating the risks associated with geopolitics while still capitalizing on growth opportunities. The company’s ability to adapt to these changes will determine its future trajectory in the semiconductor market and beyond, highlighting the interconnectedness of global trade and technology.

The Future of AI and Samsung’s Semiconductor Strategy

Looking ahead, the role of artificial intelligence in the semiconductor industry will only continue to grow, presenting both challenges and opportunities for companies like Samsung. As demand for AI-driven technologies rises, Samsung is keen on positioning itself as a leader in this segment by investing in the development of next-generation AI chips that cater to a spectrum of applications, including automotive and consumer electronics.

By leveraging its vast expertise in semiconductor design and manufacturing, Samsung hopes to secure a competitive edge in the evolving market landscape. The company’s proactive approach in developing advanced AI chip technologies not only aligns with current trends but also aims to preemptively address the challenges posed by export restrictions and market demands.

Samsung’s Efforts to Revive Sales in Mobile Devices

Samsung is strategically positioning its mobile experience division for continued success following a notable increase in sales during the second quarter. By implementing targeted marketing strategies geared towards showcasing the innovative features of its devices, Samsung aims to revitalize interest in its product range. Emphasizing the intelligent functionalities of the Galaxy A series in particular, the company is keen to expand its market share amidst rising competition.

To sustain the momentum, Samsung’s approach includes a flagship-first strategy focusing on its foldable devices and the premium Galaxy S25 series. This strategy is designed to not only meet existing consumer needs but also capitalize on new market segments that favor advanced technologies and unique product offerings.

Navigating Semiconductor Market Trends amidst Uncertainty

As Samsung Electronics navigates through turbulent times in the semiconductor landscape, understanding market trends becomes essential. The industry is facing intense pressure due to fluctuating demand, competitive pricing, and geopolitical factors that influence supply chains. Samsung’s ability to adapt to these changing market dynamics will be crucial in ensuring steady growth and profitability for its semiconductor operations.

By closely monitoring consumer demands and aligning production capabilities with market needs, Samsung aims to mitigate risks associated with semiconductor production. Keeping an eye on trends in memory chip prices and cutting-edge AI technologies will be fundamental in guiding Samsung’s future decisions and investments within this critical sector.

Frequently Asked Questions

What are the key takeaways from Samsung Electronics Q2 results for 2023?

Samsung Electronics reported a second-quarter operating profit of 4.7 trillion won, which, while exceeding its projection, signifies a sharp decline from last year’s 10.44 trillion won. The slight increase in revenue to 74.6 trillion won reflects resilience despite challenges, notably U.S. export restrictions impacting AI chip sales to China.

How did Samsung Electronics profit decline in Q2 impact its semiconductor business?

In Q2 2023, Samsung’s Device Solutions division, which encompasses the semiconductor business, saw a staggering 93.8% drop in operating profit year over year, down to 400 billion won from 6.45 trillion won. This decline is primarily attributed to inventory adjustments and the negative impacts from export restrictions on AI chips.

What drove Samsung’s mobile sales to increase in Q2 2023 despite overall profit decline?

Samsung’s mobile sales grew due to strong demand for its Galaxy S25 series and Galaxy A series smartphones. The mobile experience division posted an operating profit increase to 3.1 trillion won from 2.23 trillion won last year, along with a revenue rise to 29.2 trillion won, reflecting successful marketing strategies and product launches.

What factors contributed to the poor performance of Samsung Electronics Q2 earnings?

Samsung Electronics Q2 earnings fell short of expectations primarily due to significant profit declines in its semiconductor division, caused by U.S. export restrictions on AI chip sales to China and inventory adjustments. Despite a slight increase in overall revenue, the sharp drop in operating profit highlights ongoing challenges in the semiconductor market.

Are there any positive predictions for Samsung’s foundry operations following the Q2 results?

Yes, Samsung’s foundry operations are anticipated to improve in the upcoming quarters due to a $16.5 billion contract to supply chips to a major company, possibly Tesla. This contract may significantly boost Samsung’s position in the semiconductor market and offset declines seen in other divisions.

How does Samsung plan to adapt after the decline in its Q2 semiconductor profits?

In response to the decline in its semiconductor profits, Samsung intends to focus on high-value-added and AI-driven products. The company is also committed to enhancing its competitiveness in advanced semiconductor technologies to adapt to changing market conditions.

What impact do AI chip export restrictions have on Samsung’s Q2 results?

The AI chip export restrictions imposed by the U.S. negatively impacted Samsung’s Q2 results, particularly affecting its Device Solutions division and contributing to the profit decline. The company acknowledged these restrictions as a key challenge affecting its semiconductor business profitability.

What strategies is Samsung implementing for its mobile experience division following Q2 results?

Following Q2 results, Samsung plans to maintain a flagship-first strategy for its mobile experience division, focusing on foldable devices and the Galaxy S25 series while leveraging AI functionality in the Galaxy A series to enhance market share in the smartphone sector.

| Key Metrics | Q2 2023 Results | Comparison to Estimates |

|---|---|---|

| Operating Profit | 4.7 trillion won | 4.7 trillion won (vs. 5.33 trillion won estimate) – Below expectations. |

| Revenue | 74.6 trillion won ($53.5 billion) | 74.6 trillion won (vs. 74.43 trillion won estimate) – Slightly above forecast. |

| Chip Division Operating Profit | 400 billion won | Down from 6.45 trillion won year-over-year. |

| Mobile Division Operating Profit | 3.1 trillion won | Increased from 2.23 trillion won year-over-year. |

| Key Factors | Export restrictions on AI chips to China | Strong sales of Galaxy S25 and A series devices. |

Summary

Samsung Electronics Q2 results indicate a significant decline in operating profit, reflecting the challenges from U.S. export restrictions on advanced AI chips to China. Despite this, revenue slightly increased, signaling resilience in certain divisions. The company aims to capitalize on the rising demand for high-value addition and AI-driven products in the upcoming quarters while focusing on its flagship devices to maintain competitiveness. Overall, Samsung’s strategic moves and adaptations could help navigate the ongoing market challenges.