Firefly Aerospace IPO is capturing the attention of investors as the Texas-based rocket manufacturer prepares to go public on the Nasdaq debut this Thursday with ticker symbol “FLY.” Priced at $45 per share, Firefly’s initial offering surpassed its anticipated range, raising an impressive $868 million and valuing the company at about $6.3 billion. This surge in public interest comes amid a growing appetite for space technology news and investment in innovative firms like Firefly Aerospace. Investors are keen to monitor the Firefly stock price as the company expands its reach in the competitive aerospace industry, which boasts significant backing from figures like Elon Musk and Jeff Bezos. With ambitious plans to develop lunar landers and more, Firefly Aerospace is poised to make waves in the space sector.

The recent initial public offering (IPO) of Firefly Aerospace highlights a pivotal moment for this burgeoning rocket manufacturer as it ventures into the public markets. The company, which focuses on advanced space exploration technologies, is looking to capitalize on rising investor enthusiasm in the astronautic domain. Known for its cutting-edge lunar landers and high-profile contracts with organizations like NASA, Firefly’s upcoming market introduction under the ticker “FLY” is generating considerable buzz. As new developments unfold in the aerospace sector, the IPO signifies a broader trend where technology firms are successfully entering the NASDAQ market, invigorating interest around rocket manufacturers and their innovative capabilities. Following substantial capital infusions and strategic partnerships, Firefly’s financial trajectory is one to watch in the coming months.

Firefly Aerospace IPO Overview

Firefly Aerospace has made waves in the investment community with its recent IPO priced at $45 per share, significantly exceeding expectations. The Texas-based rocket manufacturer is preparing for its much-anticipated Nasdaq debut under the ticker symbol “FLY” this Thursday. The offering has successfully raised an impressive $868 million, placing an approximate valuation of $6.3 billion on the company. This pricing is part of a strategic move to capitalize on the burgeoning interest in the aerospace sector, reflecting the ongoing shift toward privatization in space exploration.

The excitement surrounding the Firefly IPO underscores a captivating narrative in the space technology arena, as public offerings increase momentum in this sector. Firefly’s initial pricing strategy aimed to establish a strong market presence, and the adjusted share price signifies both confidence from investors and a robust outlook on future growth. As more companies reach the public markets, Firefly’s upcoming Nasdaq debut will likely attract significant attention from investors keen on joining the rocket manufacturing boom.

Innovative Technologies and Partnerships

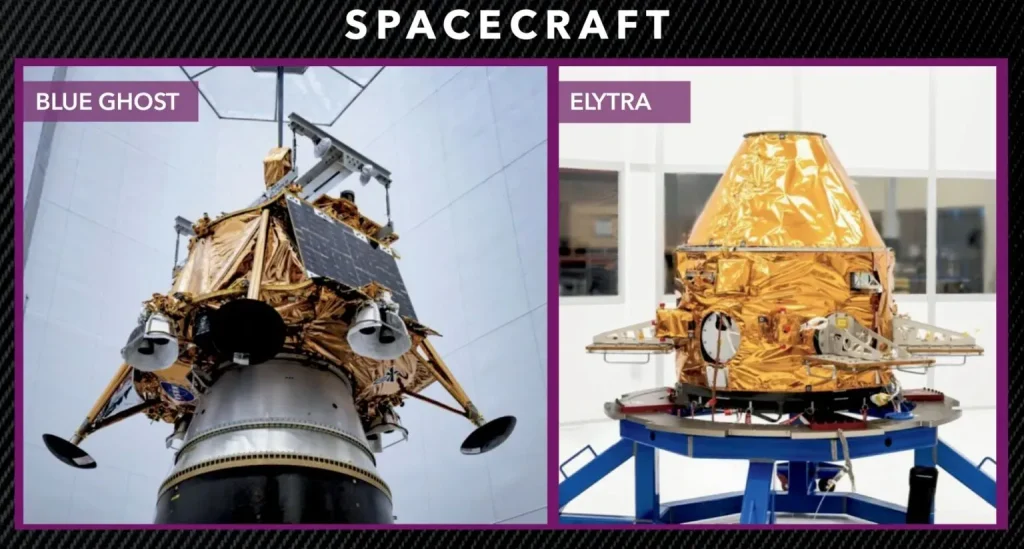

Firefly Aerospace stands out in the competitive landscape of space technology for its advanced developments in lunar landers and rockets. Recently, the company made headlines after securing a lucrative $177 million contract with NASA, solidifying its role in larger government contracts and space missions. The successful landing of its lunar lander, named Blue Ghost, marks a significant milestone, showcasing Firefly’s engineering capabilities and commitment to innovation in aerospace technology.

Furthermore, Firefly has been proactive in building relationships with prominent defense contractors such as Lockheed Martin, L3Harris, and Northrop Grumman, the latter investing $50 million in Firefly earlier this year. These partnerships not only bolster Firefly’s operational capacity but also enhance its credibility within the industry. As the company gears up for its IPO, its innovative projects and strategic alliances put it in a favorable position to leverage the growing demand for effective and reliable space technology.

Market Trends: The Rise of Space Technology Stocks

The recent surge of interest in space-related investments has led to a notable increase in the number of companies going public in the sector. With billionaires like Elon Musk and Jeff Bezos actively supporting their ventures, namely SpaceX and Blue Origin, the enthusiasm around space technology is at an all-time high. The successful IPOs from companies such as Firefly Aerospace signal a rejuvenated market for public offerings, particularly within industries tied to innovation and future exploration.

In addition to Firefly, other companies like Voyager Technology and Karman Holdings have joined the public fray, highlighting a growing acceptance and interest from investors in space exploration ventures. These trends reflect not only a rebound in the IPO market after a temporary slow period but also showcase the confidence that investors have in the potential of space technology stocks to deliver substantial returns in the future.

Financial Performance and Growth Potential

For the quarter ending in March, Firefly Aerospace reported a net loss of approximately $60.1 million, an increase from the previous year. Despite this, the company saw a remarkable surge in revenue, skyrocketing to $55.9 million from just $8.3 million. Such growth, coupled with a solid backlog of about $1.1 billion, positions Firefly remarkably well for future expansion. Investors looking at the Firefly stock price will find encouraging signs of robust demand for its services and technologies.

The financial results indicate that, while current losses exist, they are not uncommon in the rocket manufacturing domain, especially for companies heavily investing in research and development. The revenue growth showcases Firefly’s ability to capture market interest and adapt to competitive pressures in a rapidly evolving industry. As the company pivots from development to execution, investors could anticipate a more stable and profitable trajectory ahead.

Impact of COVID-19 on Space Industry

The COVID-19 pandemic has had far-reaching effects across various industries, including the space sector. For companies like Firefly Aerospace, operational adjustments were necessary to navigate challenges while maintaining momentum in project timelines. Despite initial setbacks, the pandemic also accelerated innovations in space technology and ignited a renewed focus on both public and private space exploration initiatives.

As the world transitions into a post-pandemic phase, there is a clear resurgence in investor confidence within the space industry. The pandemic served as a catalyst for increased governmental spending on innovative technologies, thereby benefiting companies like Firefly. This rebound not only enhances Firefly’s market position but also underscores the importance of stability within the space industry as it continues to gain traction in the broader technology landscape.

The Role of NASA in Firefly’s Success

NASA’s substantial contracts and collaborative efforts with private space companies have become pivotal in shaping the future of space exploration. Firefly Aerospace, having recently secured a $177 million contract, exemplifies how these partnerships can catalyze growth and legitimacy within the industry. This collaboration underscores the critical role that government agencies play in fostering advancements in space technologies, ensuring that innovative companies have the backing needed to thrive.

Moreover, NASA’s ongoing support for private enterprises such as Firefly is indicative of a larger trend where governmental goals align with private sector capabilities. This synergy has the potential to accelerate advancements in rocket manufacturing and lunar exploration, which in turn may yield significant benefits for investors and public confidence in the space economy.

Strategic Moves and Future Outlook for Firefly

As Firefly Aerospace approaches its Nasdaq debut, strategic moves will play a crucial role in determining its immediate success and long-term viability. By focusing on expanding its technological capabilities and strengthening partnerships, Firefly not only ensures its place in the competitive market of space technology but also prepares for potential future endeavors that can elevate its standing. Investors are keenly watching these developments, eager to see how they translate into the company’s growth trajectory post-IPO.

The company’s successful prior milestones, such as the landing of the Blue Ghost lunar lander, raise expectations for future achievements. With a firm commitment to innovation, Firefly is positioned to capitalize on burgeoning opportunities in space technology. The outlook remains bright as the demand for cutting-edge aerospace solutions continues to rise, providing Firefly with a robust pathway for sustained growth and profitability.

Understanding Firefly Stock Price Movements

Investors keen on diving into Firefly Aerospace stock must understand the factors that influence its price movements. As the company prepares for its IPO, market sentiment and broader economic trends will play a significant role. The recent successful pricing of shares at $45 reflects a positive outlook from investors, as expectations run high for the company’s performance post-NASDAQ debut.

Additionally, fluctuations in Firefly’s stock price will likely be influenced by its operational achievements, contract acquisitions, and participation in significant events such as lunar missions. Maintaining transparency with investors and communicating milestones effectively can help Firefly stabilize its stock price and foster investor loyalty, crucial for weathering the inherent volatility associated with tech-based IPOs.

Comparative Analysis: Firefly vs. Competitors

In evaluating Firefly Aerospace’s competitive landscape, comparisons with other players like SpaceX and Blue Origin become relevant. Both companies have set high benchmarks in rocket manufacturing and space exploration, with substantial investments and innovative techniques. Firefly’s focus on niche markets, such as lunar landers, gives it a unique edge in a crowded marketplace, catering to specific governmental and commercial needs that established giants may overlook.

By honing its business strategy and differentiating its technological innovations, Firefly can capture market share while providing robust alternatives to existing offerings. This comparative analysis not only illustrates Firefly’s positioning but also informs potential investors about the unique opportunity presented by the firm amid a market dominated by larger counterparts.

Frequently Asked Questions

What factors influenced Firefly Aerospace’s IPO pricing?

Firefly Aerospace’s IPO pricing was influenced by increased demand and investor interest in the space technology sector. The company priced its shares at $45, exceeding the expected range of $41 to $43 per share. This pricing reflects Firefly’s strong position in the market, especially after securing substantial contracts with NASA and reporting significant revenue growth, indicating robust investor confidence.

When does Firefly Aerospace debut on NASDAQ and under what ticker symbol?

Firefly Aerospace is set to debut on NASDAQ this Thursday under the ticker symbol ‘FLY’. This marks an important milestone for the company as it enters the public market amid growing interest in space technology investments.

How much capital did Firefly Aerospace raise through its IPO?

Firefly Aerospace raised approximately $868 million through its IPO, which significantly values the company at about $6.3 billion. This influx of capital is crucial for the company’s ongoing development of rockets and lunar landers.

What recent achievements has Firefly Aerospace made in space technology?

Firefly Aerospace has made notable achievements, including successfully landing its lunar lander, Blue Ghost, on the moon. Additionally, the company secured a $177 million contract with NASA, further establishing its reputation in the space technology field.

What is the current financial status of Firefly Aerospace based on their latest quarterly report?

In their latest quarterly report for the quarter ending in March, Firefly Aerospace reported a net loss of approximately $60.1 million, an increase from a loss of $52.8 million in the previous year. However, the company’s revenue surged sixfold to $55.9 million, driven by strong demand for its space technology solutions.

How does Firefly Aerospace compare to other players in the space technology sector?

Firefly Aerospace stands out in the space technology sector, especially when compared to competitors like SpaceX and Blue Origin. With significant backing from defense contractors and a recent surge in revenue, Firefly is positioned to capitalize on the renewed investor interest in the space industry, reminiscent of the recent public offerings from companies like Voyager Technology and Karman Holdings.

What types of partnerships has Firefly Aerospace established in the industry?

Firefly Aerospace has partnered with major defense contractors, including Lockheed Martin and L3Harris, to advance their technology and mission objectives. Additionally, Northrop Grumman’s investment of $50 million in Firefly this year demonstrates significant confidence in the company’s future in the space technology landscape.

What is the market trend for space technology IPOs this year?

The market trend for space technology IPOs this year shows a revival, with significant interest from investors looking to capitalize on the expanding industry. Companies like Firefly Aerospace are entering the market alongside others such as Figma and Circle, signaling a strong reopening of the IPO landscape after a period of stagnation.

| Key Point | Details |

|---|---|

| Share Pricing | Priced at $45 per share, exceeding the expected range of $41 to $43. |

| IPO Details | Debuting on Nasdaq under the ticker symbol “FLY” with a total of $868 million raised. |

| Company Valuation | Valued at approximately $6.3 billion after the IPO. |

| Recent Contracts | Secured a $177 million contract with NASA. |

| Partnerships | Collaborating with major defense contractors like Lockheed Martin, L3Harris, and Northrop Grumman. |

| Financial Performance | Reported a net loss of $60.1 million for the quarter ending in March, but revenue increased to $55.9 million. |

| Market Context | Surge in investor interest in the space technology sector, with several companies going public in recent months. |

Summary

The Firefly Aerospace IPO represents a significant milestone in the rapidly evolving space technology sector. By pricing shares at $45, Firefly Aerospace not only exceeded its expected pricing range but also successfully raised $868 million, reflecting strong investor interest. As the company prepares to list on Nasdaq under the ticker “FLY,” its valuation of approximately $6.3 billion places it at the forefront of the growing commercial space industry. With partnerships with esteemed defense contractors and recent successes like securing a contract with NASA, Firefly is well-positioned for future growth and innovation in lunar exploration and beyond.