Global Trade Trends are reshaping profitability for businesses across industries and signaling a broader reorientation of how value is created and captured in the global economy. As post-pandemic markets adjust and technology accelerates, companies confront new cost structures, tighter margins, and fresh opportunities to reach customers across more regions. Tariffs and trade policies can shift input costs and competitive dynamics, prompting closer attention to supplier selection and pricing strategies. At the same time, supply chain resilience becomes a critical profitability lever, rewarding firms that diversify suppliers, build buffers, and deploy digital visibility tools to reduce disruption costs. Understanding these forces helps managers forecast demand, optimize sourcing, and design adaptive business models that sustain margins in a rapidly changing cross-border environment.

From a different angle, the same movement can be described as shifts in cross-border trade dynamics and global commerce patterns that influence profitability and investment timing. Alternative framings like world market integration, regional demand realignments, and international business exchange reflect the same core forces highlighted in the opening, just with different terminology. Firms should track tariff climates, policy signals, and logistics performance to anticipate costs and maintain pricing power, no matter which label is used. Emphasizing supply chain resilience, end-to-end visibility, and digital collaboration helps organizations turn uncertainty into steady growth across regions. By connecting synonyms to the underlying drivers—demand shifts, policy risk, and technology-enabled efficiency—leaders can design robust strategies that endure in a changing global marketplace.

Global Trade Trends: Emerging Markets and International Trade Profitability

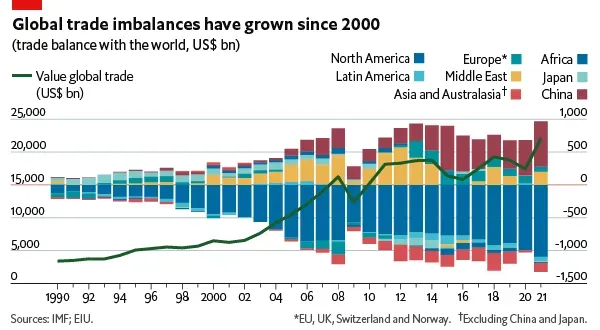

Global Trade Trends are reshaping where value is created, with demand shifting toward high-growth regions and automation altering cost structures. As global trade dynamics evolve, emerging markets trade trends gain prominence, offering new opportunities for international trade profitability for firms prepared to adjust sourcing and product strategies. This shift affects margins by changing input costs, logistics complexity, and currency exposure, underscoring the need for agile forecasting and regional market intelligence.

Forward-looking companies time procurement and pricing around regional demand cycles, leveraging nearshoring and diversified supplier bases to stabilize cash flow. By balancing cost efficiency with resilience, they reduce exposure to port congestion, tariff shocks, and supply disruptions, while using digital tools to optimize inventory, negotiate better terms, and sustain competitive pricing that preserves margins.

Tariffs, Trade Policies, and Supply Chain Resilience: Maximizing Profitability in a Shifting Global Trade Landscape

Tariffs and trade policies remain central to profitability as policy dynamics shape input costs, price competitiveness, and market access. Monitoring tariffs and trade policies enables scenario planning, hedging, and transparent pass-throughs to customers, helping sustain international trade profitability in volatile environments. Firms should build flexible supplier networks and prudent inventory buffers to absorb duty shocks and compliance costs while pursuing growth in cross-border channels.

Alongside policy awareness, strengthening supply chain resilience through multi-sourcing, digital visibility, and proactive contingency planning reduces risk from sanctions, transport bottlenecks, and energy price volatility. Robust FX risk management and technology-enabled data exchange further stabilize margins by improving forecast accuracy, optimizing freight choices, and enabling price adjustments that reflect evolving tariffs and duties. In this way, enterprises align tariffs and trade policies with strong profitability within a changing global trade landscape.

Frequently Asked Questions

What are the main forces behind Global Trade Trends and how do they affect international trade profitability?

Global Trade Trends are shaped by global trade dynamics, emerging markets trade trends, policy shifts, currency movements, and supply chain resilience. These forces influence profitability by altering regional demand, input costs, lead times, and risk exposure. To protect margins, firms can diversify suppliers, pursue nearshoring or reshoring, hedge currencies, invest in digital trade tools, and adjust pricing to reflect changing duties and costs.

How do tariffs and trade policies influence Global Trade Trends, and what strategies help maintain profitability?

Tariffs and trade policies are central to Global Trade Trends, impacting cost structures and competitive dynamics across markets. To manage profitability, businesses should monitor policy developments, run scenario planning for different tariff regimes, maintain flexible supplier networks, build strategic stock, and consider hedging or transparent pass-through pricing. Additionally, optimizing logistics and exploring favorable trade terms can help protect margins amid policy shifts.

| Aspect | Key Points | Implications for Profitability |

|---|---|---|

| Global Trade Trends overview | Global Trade Trends reshape profitability across industries amid post-pandemic realities, geopolitical shifts, and rapid technological change. They redefine how demand is distributed and how policy choices and digital innovations affect cross-border transactions. | Create new cost structures, margin pressures, and growth opportunities for many firms. |

| 1) Global trade dynamics and profitability | Supply chains and demand are reoriented; diversification, nearshoring, and reshoring increase regional focus. | Diversification can stabilize costs and improve long-term margins; closer regional sourcing can shorten lead times and cut freight costs. |

| 2) Policy forces: tariffs, trade policies, and market access | Tariffs and policies change input costs and competitive dynamics; trade agreements shape market opportunities and compliance. | Profitability hinges on hedging, flexible sourcing, and adaptive pricing to reflect duty costs and policy shocks. |

| 3) Supply chain resilience as a profitability lever | Investments in multi-sourcing, nearshoring, safety stock, and digital visibility reduce disruption risk. | Upfront costs are offset by lower outage costs, steadier delivery, and more confident pricing decisions. |

| 4) Currency, financing costs, and cost pressures | FX movements and financing costs influence margins; energy and logistics costs remain significant. | Robust FX risk management and efficiency improvements help protect and stabilize margins. |

| 5) Regional and sectoral implications | Regions show distinct trajectories: Asia (manufacturing, automation), Europe (decarbonization), North America (reshoring). Sectoral nuances exist (electronics, automotive, consumer goods, agriculture). | Strategic investments and pricing must be tailored by region and sector to preserve profitability. |

| 6) Technology and digitization | Digital trade platforms, e-invoicing, data sharing; analytics, AI forecasting, and blockchain improve transparency and trust. | Increases throughput with lower overhead and supports stronger margins amid volume fluctuations. |

| 7) Sustainability, ESG, and regulatory environment | ESG considerations (carbon border adjustments, due diligence, compliance) affect costs and access; ESG can enable premium pricing. | Aligning profitability with sustainable practices can open new opportunities and reduce risk exposure. |

Summary

Conclusion: Global Trade Trends are shaping profitability by redefining how supply chains are structured, how policies affect costs, and how technology drives efficiency. To thrive, organizations should build agile sourcing strategies, diversify supplier bases, and hedge currency risks while leveraging digital tools to streamline trade operations. By understanding the interplay of global trade dynamics, tariffs and trade policies, supply chain resilience, and regional and sectoral nuances, leaders can protect margins and identify opportunities to grow in a complex but highly interconnected global market. In this evolving environment, resilient operations, proactive planning, and data-driven decision-making are essential to sustaining profitability amid ongoing change.