Small Business Financing is a cornerstone of growth in today’s fast-changing economy, shaping whether an idea becomes a thriving customer-facing venture and a sustainable employer. This introductory guide explores how entrepreneurs can find capital, navigate grants, and steer startups toward sustainable momentum, blending practical advice with clear steps to secure funding, all while demystifying the process. From boots-on-the-ground strategies for applying to small business grants to spotting funding opportunities that fit your milestones, the roadmap emphasizes affordability, accountability, and smart risk taking for long-term resilience in competitive markets. Whether you are bootstrapping, pursuing a loan, or chasing non-dilutive awards, the emphasis remains on aligning financing choices with your growth plan rather than chasing the biggest check, so you can weather downturns and scale thoughtfully. By understanding financing options for small business and building a disciplined plan, you can turn capital into lasting value for your team and customers, while preserving flexibility to pivot as opportunities arise.

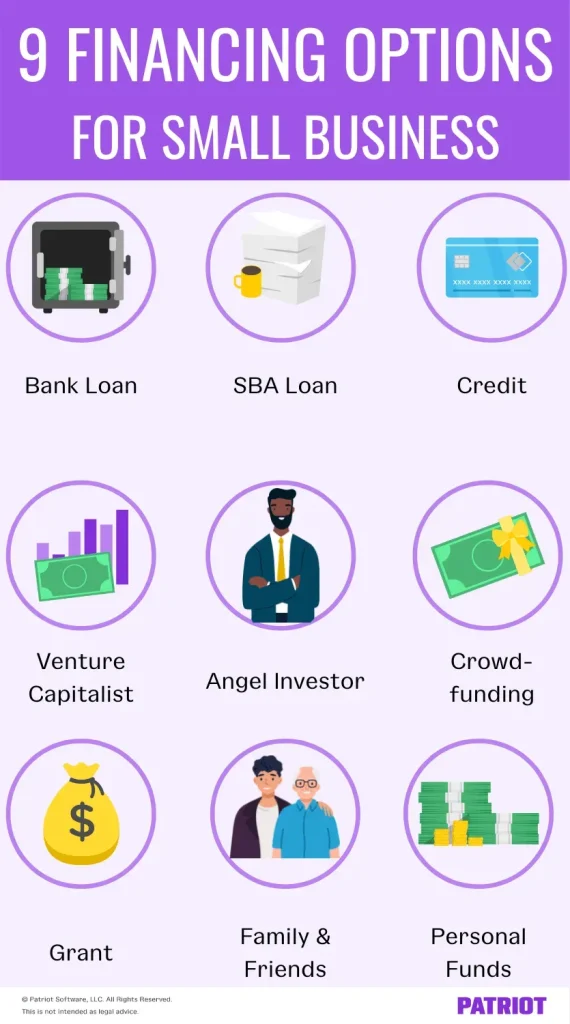

Beyond the basics, capital access for small enterprises relies on a spectrum of funding channels that extend beyond traditional bank loans. Consider government programs, university and foundation grants, community development initiatives, as well as debt facilities, equity investments, and alternative financing. This broader lens supports risk diversification, preserves founder ownership, and aligns funding with specific milestones such as product launches and customer validation. Non-dilutive options, like grants and research subsidies, can boost capabilities without equity surrender, while strategic partnerships and venture support can accelerate scale. By mapping milestones to a diversified mix of capital sources, you build resilience and confidence to pursue growth at the right pace.

Small Business Financing: A Strategic Blend of Debt, Grants, and Equity for Growth

Small Business Financing is a strategic toolkit that goes beyond a single loan product. Effective financing aligns with your growth milestones, cash flow needs, and product timelines, ensuring you have the capital to reach key targets without giving up unnecessary control. In this context, diversifying across financing options for small business—debt, grants, and select equity—helps you manage cost of capital while preserving ownership where it matters most.

A blended approach often yields the strongest runway. Debt financing such as lines of credit or SBA-backed lending can smooth working capital, while non-dilutive funding from grants provides capital without equity loss. For high-growth opportunities, selective equity funding can accelerate scale, though it requires careful consideration of dilution and investor oversight. Even with debt and equity on the table, grants remain a powerful tool to fund equipment, R&D, or market expansion while maintaining ownership.

Practical guidance for building this mix includes forecasting milestones, cash burn, and the timing of funding rounds. Start with a robust financial model that captures revenue trajectories, margins, and capital needs 12–24 months out. Then map debt facilities, grant opportunities for small business, and strategic equity so each funding source lines up with a specific milestone—product launch, regulatory clearance, or customer validation—to maximize credibility with lenders, grantors, and investors.

Grant Opportunities for Small Business: Finding, Applying, and Winning Non-Dilutive Funding

Grant opportunities for small business can come from government agencies, universities, local economic development groups, and private foundations. These small business grants offer non-dilutive capital, meaning you don’t surrender equity while still advancing your product roadmap or community initiatives. The odds of success improve when your project clearly matches grant goals, demonstrates measurable impact, and presents a credible, data-driven plan.

To pursue grants effectively, start with a grant-readiness assessment: ensure your business plan is solid, financials are up to date, and you can articulate the problem, solution, and market opportunity. Build a grant-ready package that includes an executive summary, problem-solution narrative, market analysis, team bios, and a detailed budget with outcomes. Tailor each proposal to funder priorities, gather supporting materials, and track deadlines with a simple grant-management workflow.

Beyond the application itself, maintain a feedback loop: seek input from mentors or grant consultants, refine your proposals based on funder priorities, and use any award to build momentum for future startup funding opportunities. Even when grants aren’t awarded, the process often strengthens your business case for other financing options for small business and helps you access non-dilutive funding for essential initiatives.

Frequently Asked Questions

What is Small Business Financing and how do I build a balanced financing mix for my startup?

Small Business Financing is a strategic toolkit that combines debt financing, equity financing, non-dilutive funding, and other options to support growth. The best mix depends on your stage, cash flow, and milestones. Start by assessing your runway and milestones, then consider lines of credit for working capital, grant opportunities for small business to secure non-dilutive funds, and selective equity for high-growth opportunities. Build a plan that balances cost of capital, ownership, and time-to-market, and nurture relationships with lenders and grant officers to improve terms. For example, many startups pair a microloan or line of credit with a government or private grant to fund equipment or R&D while preserving equity for future rounds.

How can I identify grant opportunities for small business and leverage small business grants without giving up equity?

Start with a grant-readiness assessment to ensure your business plan, financials, and impact metrics are solid. Build a grant-ready package including an executive summary, problem-solution narrative, market analysis, team bios, and a detailed budget. Tailor each proposal to funder priorities, gather supporting materials, and track deadlines with a simple grant-management process. Remember that grant opportunities for small business are not guaranteed, but non-dilutive funding can fund equipment upgrades, R&D, or community initiatives while preserving ownership. Complement grants with other financing options for small business to maintain a diversified funding strategy and reduce risk.

| Topic / Area | Key Points | Notes / Examples |

|---|---|---|

| Introduction |

|

From the base content summary |

| Understanding Small Business Financing Today |

|

Foundational categories and strategy |

| Grants: A Pathway to Non-Dilutive Funding |

|

Non-dilutive capital with strategic use cases |

| Startup Funding Opportunities and Financing Options |

|

Diverse financing options across stages |

| Finance Strategy for Startup Success |

|

Strategic planning and funding alignment |

| How to Identify and Apply for Grants Effectively |

|

Structured grant application process |

| Case Studies in Financing for Growth |

|

Illustrative outcomes and momentum |

| Tips for Startup Success and Long-Term Growth |

|

Operational excellence and growth mindset |

| Grant Opportunities for Small Business: Quick Checklist |

|

Practical planning steps |

Summary

Conclusion: Small Business Financing ties together grants, debt, and equity into a strategic journey that supports sustainable growth. By understanding the landscape, pursuing grant opportunities for small business, and aligning funding with product milestones, entrepreneurs can unlock capital that accelerates innovation while preserving long-term control. A disciplined mix of financing options, clear milestones, and a compelling value proposition turns funding into lasting success for your small business.